The idea of finance and numbers send shivers down many people’s spine. Finance brings with it the days we spent in school struggling with numbers and waiting to finish high school to finally bid adieu to numbers.

However, by the time we step out to the professional world, we come to terms with the fact that finance and our life cannot be separated. It is there in every aspect of our life.

Prophet Muhammad saw said: “The son of Adam will not be dismissed from before his Lord on the Day of Resurrection until he has been questioned about five things: his life and how he spent it, his youth and how he used it, his wealth and how he earned it and how he disposed of it, and how he acted upon what he acquired of knowledge.”

Finance is intrinsic part of our life and one for which we shall be accountable to our Lord. How well we manage our finances depends a lot on how well we know our finances. The sad reality for many of us however is, we have a smile on our face on the 1st of every month (salary day) but by the mid of the month the smile vanishes and so does the salary for the month. We cut down all expenses in an unplanned manner only to keep our head above water for the month.

In today’s blog, I share with you some smart tips on how to manage your finances better and becoming financial empowered.

- The Golden Rule to Finance Empowerment ‘25:100’

The golden rule to become financially empowered is 25:100. This explains sacrificing 25% of your income every month to reach 100% happiness. This means setting aside 25% of the salary received every month in your savings and not using them for any expenditure. So, you work around your expenses using the balance 75% for the rest of the month. Keep accumulating this 25% over a period of time and you will see how different life becomes in a matter of months. The feeling of financial empowerment is a blessing from Allah. - Keeping a track of your expenses- If you fail to plan, you are planning to fail

How often you walked into a store to buy some grocery items and end up buying other items which you didn’t plan for in the first instance?’ Welcome to the world of consumerism.

This explains ‘If you fail to plan, you are planning to fail’. Little wonder, by the middle of the month, we are making serious reductions in our spending pattern to ensure we have enough left to last us for the rest of the month.

Many of you will recall how our parents and grandparents would make a list of items they needed to buy before visiting the store or the market. This was part of their planning and would make sure they don’t lose track of their expenses. However, we seem to have given up on this approach. I strongly recommend each one of you to begin this again. Keep a note-book and make a list of all items you need to buy before you step out to the market. You will be surprised how your expenses will fall in line, helping you keep a track of your expenses in a better manner.

- Prepare a budget for every month

Now that you have a track of all your expenses, prepare a projected budget for the next month and continue keeping a track of your actual expenses. The ideal situation is when you end up spending what you had projected in the beginning of the month or less. This budget should be ready before the new month begins. - Create an Emergency Fund

As you plan your expenses for the month, keep a small emergency fund (5-10%) to meet any unforeseen expenditure. This will save you from falling into interest-based debt or relying on credit cards. At the end of 6 months, you can accumulate this entire unused fund and transfer them to your ‘Financial Empowerment Fund’ (see point 1 above) - Do Charity

Charity is where blessings belong and AllahSWT rewards charity. Make sure to set aside a small fund every month for the poor. Perhaps you can sponsor a child’s education or his memorization of Al-Qur’an or clothe a poor or take up different option every month. Make sure this is consistent as AllahSWT likes deeds which are consistent.

Reap the Rewards by Supporting Students in Need with IOU – CLICK HERE

Some quick points to remember:

- Be sincere to yourself. If you are not honest to yourself in drafting the above, you will find no interest in this exercise and will end up losing motivation. Set a financial goal and manage your expenses to meet these goals

- This task involves participation of both the partners (for married couples). Sit with your spouse and plan the month together. Don’t be a dictator. There is khayr (good) and barakah (blessing) in doing things together.

- This was supposed to be the first point but I kept it last so we take this message back- Trust and Reliance in Allah- The Provider of Sustenance. A Muslim draws his strength from his belief in God and complete reliance in Him. Trusting God means accepting His blessings without any conditions. Whilst one should strive to better his standard of living (by Allah’s permission) but this should not lead to stress and other health and spiritual disorders (losing track of the purpose of existence). Acknowledging Allah’s favors brings us closer to Him and this is the one of the best means to attain Sakeenah (peace and tranquility).

As Allah SWT says, “Therefore remember Me (by praying, glorifying). I will remember you, and be grateful to Me (for My countless favors on you) and never be ungrateful to Me” [Quran, Surah Baqarah, 2:152]

Please let us know your thoughts and suggestions in the comments section below. 🙂

About the Author-

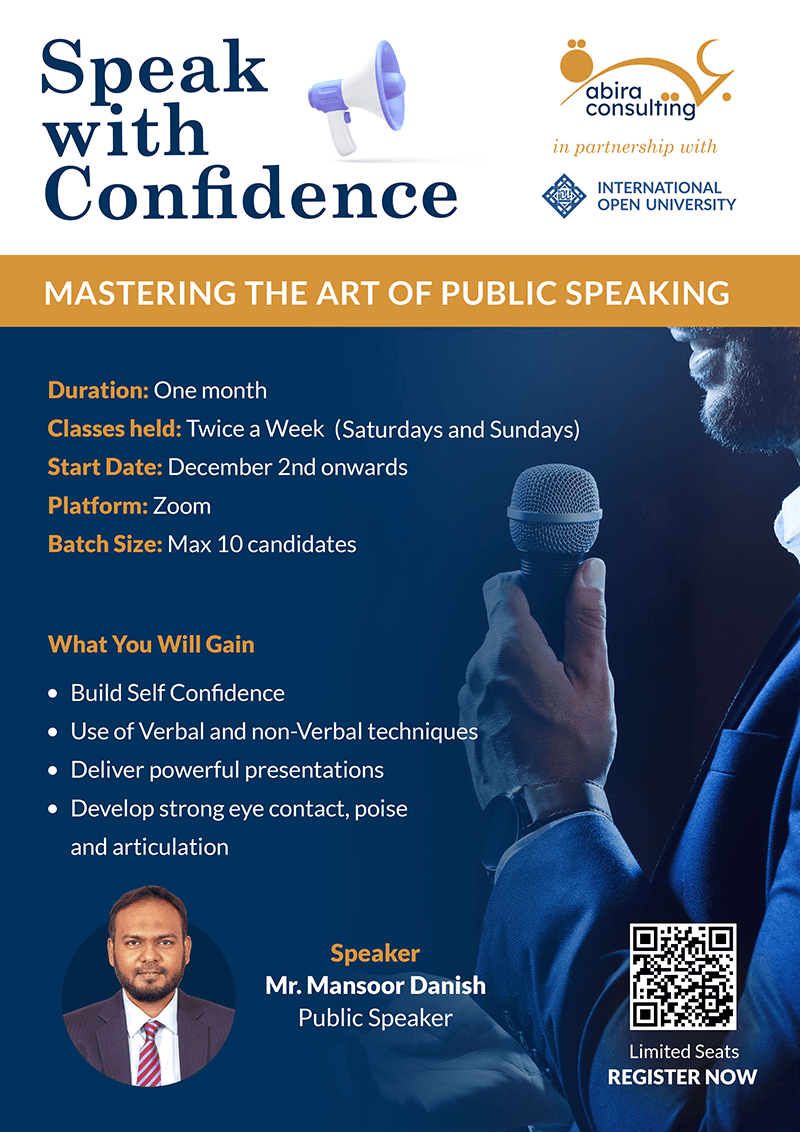

Mansoor Danish is a Lecturer and Supervisor with Islamic Online University and private Wealth Consultant. He can be reached here www.mansoordanish.com

- Narrated by al-Tirmidhi, 2422; classed as hasan by al-Albaani in Saheeh al-Tirmidhi, 1969